Â鶹´«Ã½ Activity Remained Contractionary in December

Â鶹´«Ã½ activity remained contractionary at the same rate as in November. Stable contraction is relatively good in the current environment.

Share

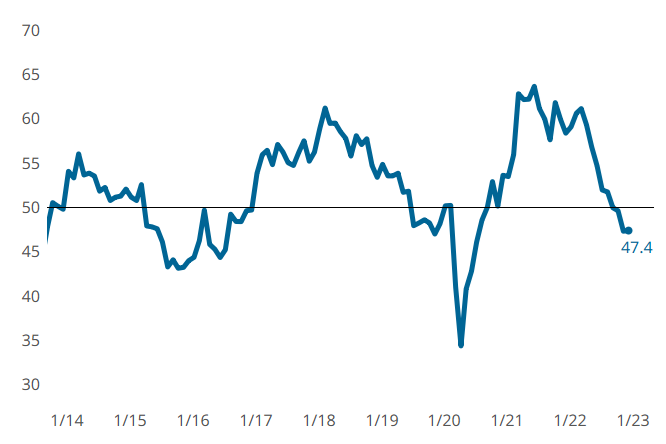

The Â鶹´«Ã½ GBI contracted, about the same in December as November. Photo Credit: Gardner Intelligence

The December index closed at 47.4, essentially the same as November. Most components saw a bit faster contraction in December than November. New orders ended 2022 contracting, which has been the case since July. Backlog did the same, having started to contract in September. Production activity contracted to a lesser degree than backlog, new orders and exports, but may fall in line with the demand-based components here soon. Employment activity remained above the line, still expanding, but continually slowing, landing dangerously close to ‘flat’ in December. Supplier deliveries continued to lengthen at slower rates, with no reason to expect the pace to pick up again any time soon given the way most components are consistently tracking.

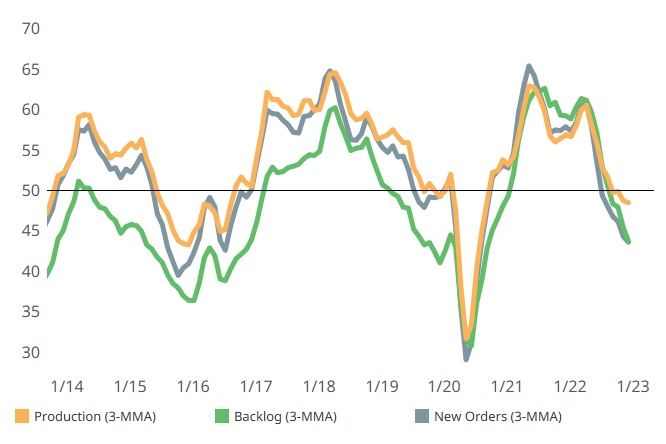

New orders and backlog activity contracted similarly in December. Production activity did not contract as much in December, but it may just be a matter of time. (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Â鶹´«Ã½ Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Â鶹´«Ã½ Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.

-

Â鶹´«Ã½ Index Shows Continued Recovery

December marks third consecutive month of metalworking improvement on the heels of increased supplier deliveries.