Record Number of Robots Ordered in First Half of 2016, Report Says

A total of 14,583 robots valued at approximately $817 million were reportedly ordered from North American companies.

Share

The North American automation industry has set new records to begin 2016, according to the Association for Advancing Automation (A3), the industry’s trade group. The advent of more automation in North American manufacturing promises increased efficiencies in production and the ability to compete globally.

A3, whose mission is to advocate and promote automation technologies, tracks the robotics, machine vision and motion control markets for its three daughter associations. A3, with its daughter organizations, RIA and MCMA, now represents 965 member companies directly involved with robotics, vision, motion control and motors.

Robot Statistics

According to A3, a total of 14,583 robots valued at approximately $817 million were ordered from North American companies during the first half of 2016. The number of units ordered in the first six months marks a new record to begin the year, growing 2 percent over the same period in 2015, which held the previous record. Order revenue decreased slightly by 3 percent in the first half of 2016. In the same timeframe, 13,620 robots valued at $838 million were shipped to North American customers. These figures represent the second highest total for units shipped and a new record for shipment revenue in the first half of a year.

The number of robots ordered by automotive OEMs and component suppliers increased 16 percent and 4 percent, respectively, to begin the year, and was the largest driver of the market’s record performance. Similarly, the food and consumer goods industry soared in the first half of the year, ordering 41 percent more robots than the same period in 2015. Total orders to all other non-automotive industries decreased 14 percent. In terms of applications, the biggest increases were seen in inspection (69 percent), assembly (38 percent) and spot welding (21 percent).

Motion Control and Motor Statistics

Global shipments for motion control products grew by 3 percent to $1.54 billion in the first half of 2016. According to MCMA, actuators/mechanical systems (11 percent) and electronic drives (8 percent) saw strong growth in the first half of the year. Motion controllers also increased by 8 percent.

The second quarter of 2016 increased on a year-over-year basis by 5 percent to $820 million. The categories which grew the most in the second quarter were electronic drives (16 percent), actuators/mechanical systems (12 percent) and motion controllers (11 percent). Additionally, the latest MCMA survey of motion control and motor suppliers revealed that the majority of industry experts believe the market will increase in the next six months.

Vision and Imaging Statistics

The machine vision market entered 2016 on the heels of two consecutive record-setting years for sales in North America. Despite a 7-percent cyclical contraction in the first half of the year to $1.1 billion, which was largely tied to the stagnation in the semiconductor industry, the machine vision market in North America remains a key growth segment within the automation landscape.

As the “eyes” of emerging smart-factories and robotic systems, machine vision is critical to the success of next-generation automation solutions. In North America, the smart camera category has grown 4 percent year over year to $157 million in the first half of 2016.

Statistics from the second quarter of 2016 indicate that the cyclical slowdown this market experienced to begin the year is subsiding. For example, machine vision systems (which includes smart cameras and application-specific machine vision systems) grew 7 percent to $495 million compared to the first quarter of 2016. Similarly, machine vision component markets (which includes cameras, lighting, optics, imaging boards and software) grew 2 percent to $80 million. Correspondingly, total machine vision sales in the second quarter of 2016 increased 6 percent over the first quarter.

Related Content

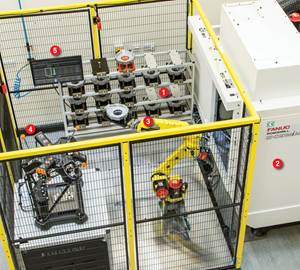

5 Stages of a Closed-Loop CNC Machining Cell

Controlling variability in a closed-loop manufacturing process requires inspection data collected before, during and immediately after machining — and a means to act on that data in real time. Here’s one system that accomplishes this.

Read MoreMedical Shop Performs Lights-Out Production in Five-Axes

Moving to five-axis machining enabled this shop to dramatically reduce setup time and increase lights-out capacity, but success relied on the right combination of workholding and automation.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read MoreInside the Premium Machine Shop Making Fasteners

AMPG can’t help but take risks — its management doesn’t know how to run machines. But these risks have enabled it to become a runaway success in its market.

Read MoreRead Next

AMRs Are Moving Into Manufacturing: 4 Considerations for Implementation

AMRs can provide a flexible, easy-to-use automation platform so long as manufacturers choose a suitable task and prepare their facilities.

Read MoreMachine Shop MBA

Making Chips and Modern Machine Shop are teaming up for a new podcast series called Machine Shop MBA—designed to help manufacturers measure their success against the industry’s best. Through the lens of the Top Shops benchmarking program, the series explores the KPIs that set high-performing shops apart, from machine utilization and first-pass yield to employee engagement and revenue per employee.

Read More