-

SPONSORED

-

SPONSORED

Economics

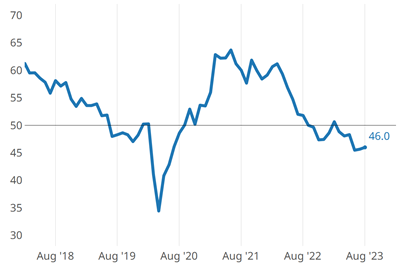

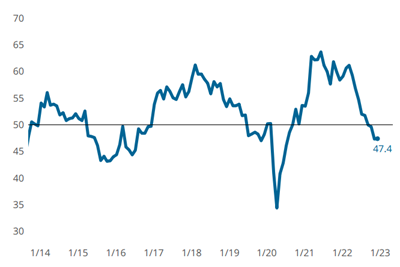

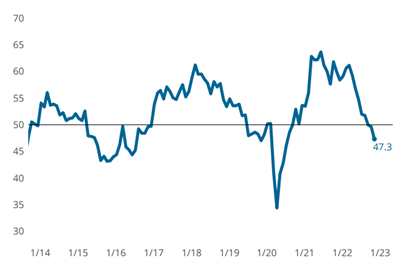

Â鶹´«Ã½ Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

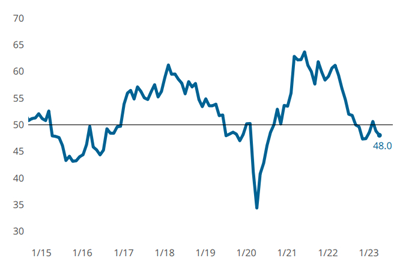

Read MoreÂ鶹´«Ã½ Activity Stayed Consistent in July

Â鶹´«Ã½ activity hung together better in July, with all but one GBI component contracting.

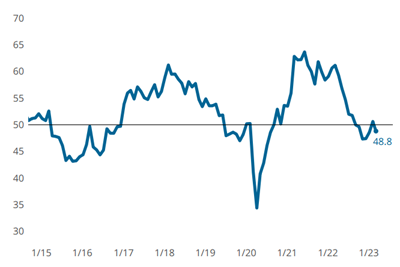

Read MoreÂ鶹´«Ã½ Activity Contracts With the Components in June

Components that contracted include new orders, backlog and production, landing on low values last seen at the start of 2023.

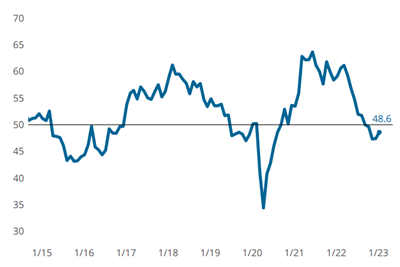

Read MoreMost Â鶹´«Ã½ GBI Components Contracted in May

Four components contracted slightly more than in April, including production, new orders, exports and backlogs.

Read MoreÂ鶹´«Ã½ Activity Contracted Marginally in April

The GBI Â鶹´«Ã½ Index in April looked a lot like March, contracting at a marginally greater degree.

Read MoreÂ鶹´«Ã½ GBI Contracted in March After One-Month Reprieve

February’s call for cautious optimism was well placed…market dynamics in March put a damper on what had been metalworking activity’s modest re-entry to growth mode in February.

Read MoreÂ鶹´«Ã½ Activity Crept Into Growth Mode in February

The GBI closed at 50.6 in February, calling for cautious optimism.

Read MoreÂ鶹´«Ã½ Activity Contraction Slows Slightly in January

Most components held steady in January, but new orders and exports showed ever-so-slight slowing of contraction.

Read MoreÂ鶹´«Ã½ Activity Remained Contractionary in December

Â鶹´«Ã½ activity remained contractionary at the same rate as in November. Stable contraction is relatively good in the current environment.

Read MoreÂ鶹´«Ã½ Activity Contracted in November

Contraction was hard to dodge with metalworking activity expansion steadily slowing since March.

Read More